WASHINGTON — The warning signs were all there. Silicon Valley Bank was expanding at a breakneck pace and pursuing wildly risky investments in the bond market. The vast majority of its deposits were uninsured by the federal government, leaving its customers exposed to a crisis.

None of this was a secret. Yet bank supervisors at the Federal Reserve Bank of San Francisco and the state of California did nothing as the bank rolled over the cliff.

“Their duty is to make sure that the bank is being run in a safe and sound manner and is not a threat,’’ said Dennis Kelleher, president of Better Markets, a nonprofit that advocates tougher financial regulations. “The great mystery here is why the supervision was AWOL at Silicon Valley Bank.’’

The search for causes and culprits — and solutions — is refocusing attention on a 2018 federal law that rolled back tough bank regulations put in place after the 2008-2009 financial crisis and, perhaps even more, on the way regulators wrote the rules that put that law in place.

The Silicon Valley Bank collapse — the second-biggest bank failure in U.S. history — is also raising difficult questions about whether the FDIC needs to offer more protection for deposits.

On March 10, regulators shuttered and seized the bank, based in Santa Clara, California. For months it had made a losing bet that interest rates would stay low. They rose instead — as the Federal Reserve repeatedly raised its benchmark rate to fight inflation — and the bank’s bond portfolio plunged in value. As its troubles became public, worried depositors started to withdraw their money in an old-fashioned bank run.

And over the weekend the federal government, determined to restore public confidence in the banking system, decided to protect all the bank’s deposits, even those that exceeded the FDIC’s $250,000 limit.

The demise of Silicon Valley Bank and of New York-based Signature Bank two days later has revived bad memories of the financial crisis that plunged the United States into the Great Recession of 2007-2009.

In the wake of that cataclysm, set off by reckless lending in the U.S. housing market, Congress passed the so-called Dodd-Frank law in 2010, tightening financial regulation. Dodd-Frank focused especially on “systemically important’’ institutions with assets of $50 billion or more — so big and interconnected with other banks that their collapse could bring the whole system down.

Those institutions had to maintain a bigger capital buffer against losses, keep more cash or other liquid assets on hand to handle a bank run, undergo annual “stress tests’’ from the Federal Reserve and write a “living will’’ to arrange for their affairs to be settled in an orderly manner if they fail.

But as the crisis faded into the past, and more and more banks grumbled about the burden of complying with the new rules, Congress decided to provide relief from the Dodd-Frank legislation. Among other things, it ditched the $50 billion asset threshold for the most stringent oversight, pushing it up to $250 billion. Many large lenders, including Silicon Valley Bank, were thereby freed from the tightest regulatory scrutiny.

Democratic Sen. Elizabeth Warren of Massachusetts, a leading critic of the banking industry, denounced the bill at the time, saying it would encourage banks to take more risk.

The law gave Federal Reserve officials the authority to reimpose tougher regulations on banks with assets between $100 billion and $250 billion if they felt it necessary.

But they chose not to be tough on those banks. For example, they required a stress test only every two years, not annually. So Silicon Valley Bank didn’t have to undergo a stress test in 2022 and wasn’t due for one until later this year.

Todd Phillips, a fellow at the left-leaning Roosevelt Institute and a former FDIC lawyer, said Congress’ deregulatory push during the Trump years created a “vibe shift.”

“It basically gave regulators permission to take their eyes off″ lenders like Silicon Valley Bank, he said. ”The regulators ran with that.’’

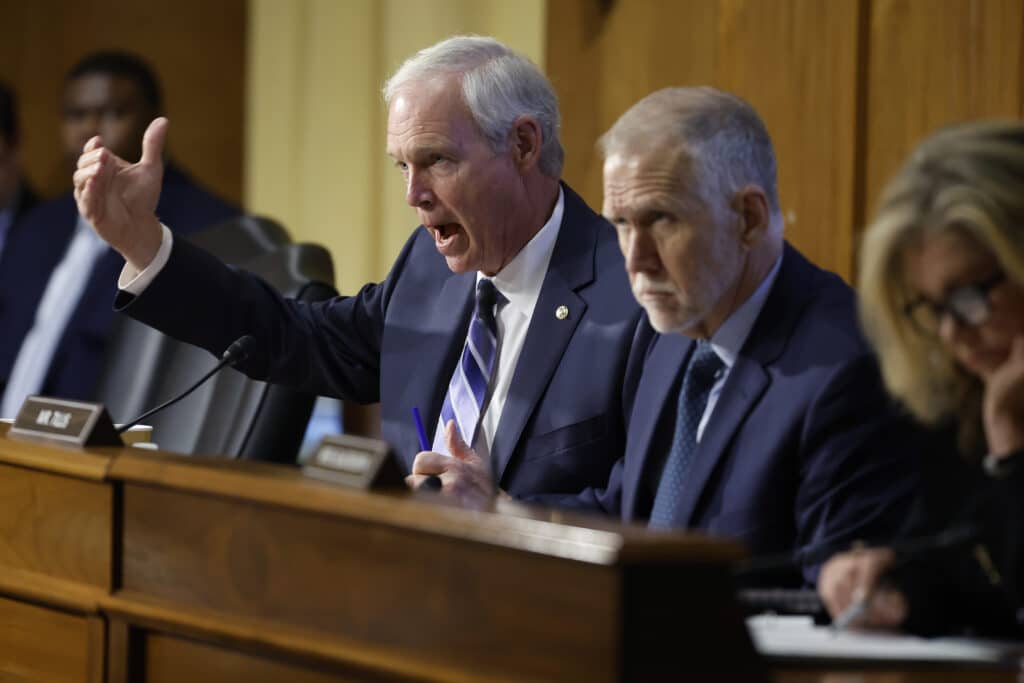

Warren and other lawmakers on Tuesday introduced legislation to undo the 2018 law and restore the tougher Dodd-Frank regulations.

But Kelleher at Better Markets said that U.S. bank regulators “don’t have to wait for a divided Congress to act in the best interests of the American public.’’

They could rewrite 20 bank-friendly rules the Fed and other bank agencies put in place during the Trump years. For example, for banks with $100 billion or more in assets, Phillips wrote in a report Wednesday, regulators should reinstate annual stress tests and raise capital requirements, among other things.

“When we roll back regulations so that bank executives can use these banks to boost their profits, to boost their own salaries, to get big bonuses, they are doing it by taking on more risk,’’ Warren told reporters Wednesday. “Banking should be boring. And we have a chance here in Congress to make banking more boring again.’’

The sudden collapse of Silicon Valley Bank has also turned attention to federal deposit insurance.

The FDIC only covers up to $250,000. But Silicon Valley Bank, the go-to institution for tech entrepreneurs, held cash for many startups: 94% of its deposits — including money that companies need to meet their payrolls — were above the $250,000 threshold and vulnerable to losses when the bank failed.

The idea that so many depositors would lose their savings threatened to shake public faith in the banking system. So the Biden administration announced Sunday night that the FDIC would cover 100% of deposits at Silicon Valley Bank, and also at Signature Bank

Now some are calling for a permanent increase in the deposit insurance limit.

“I hope now going forward they’re not going to treat this increase in the guaranteed deposits as just a one-shot response … but make it ongoing,’’ said Barney Frank, former chair of the House Financial Services Committee and director of failed Signature Bank. He also suggested an increase for businesses so they can meet payrolls.